The Impact of Supply Chain Issues on Metal Prices and Production: A Comprehensive Analysis

As industries grapple with ongoing supply chain issues in the wake of the COVID-19 pandemic and endeavor to restore production levels, the demand for metal products is expected to surge. This surge is further fueled by the increasing focus on building clean technology for renewable energy and the renewed emphasis on infrastructure development in both the United States and China. In this environment, the high metal prices are creating a perfect storm of market dynamics.

The impact of these supply chain challenges and high demand is felt across various metal markets, with the metals commonly used in industrial production experiencing the most significant effects. Steel, aluminum, copper, and nickel are particularly vulnerable to these market conditions.

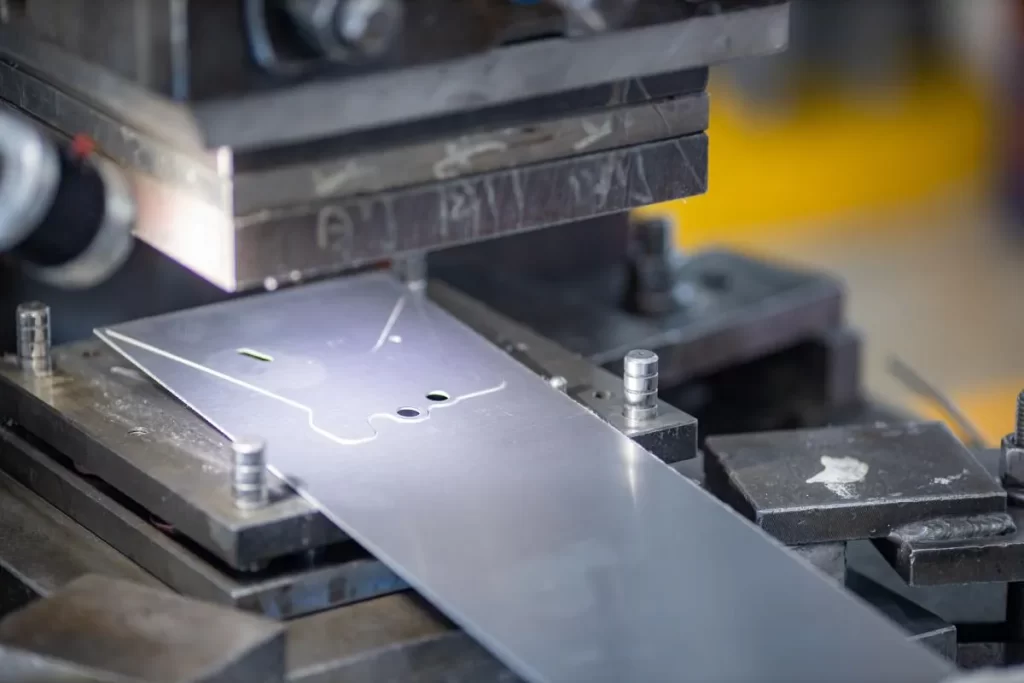

Steel and Stainless Steel:

The consolidation and reshoring of steel operations, coupled with the reduced availability of steel scrap, contribute to higher costs for steel refinement and production. These factors, combined with the increased demand for infrastructure projects, have put upward pressure on steel prices. Geosynthetic materials, which play a pivotal role in various construction projects, face similar challenges in terms of supply and cost.

Aluminum:

Canada, a key supplier of aluminum to U.S. operations, has imposed export quotas on aluminum shipments. However, the demand for aluminum in the United States surpasses the allocated quotas, resulting in limited availability and consequently higher prices.

Copper:

Copper plays a critical role in electronics, electrical components, electric vehicles, microchips, renewable energy, and energy storage. Supply shortages, driven by increased demand from these sectors, have contributed to sustained high prices for copper.

When can we expect a price decline?

While it is anticipated that record-high metal prices will gradually decline as the global economy continues to recover, a return to pre-pandemic price levels is unlikely to occur in the near future. The market is expected to remain tight well into 2022, primarily due to extensive infrastructure plans in the United States and China, which will sustain the demand for these metals.

In addition to the price impact, the ongoing pandemic has also resulted in shipping challenges, causing potential delays in material deliveries. Given the limited supply, it is advisable for manufacturers to consider extending their production lead times by several months or more in 2022.